- Key Takeaways

- Executive Summary & Reader Intent

- Banking Legacy Software Modernization: the Developer-first View

- What Banking Legacy Software Modernization Means for Financial Software Teams

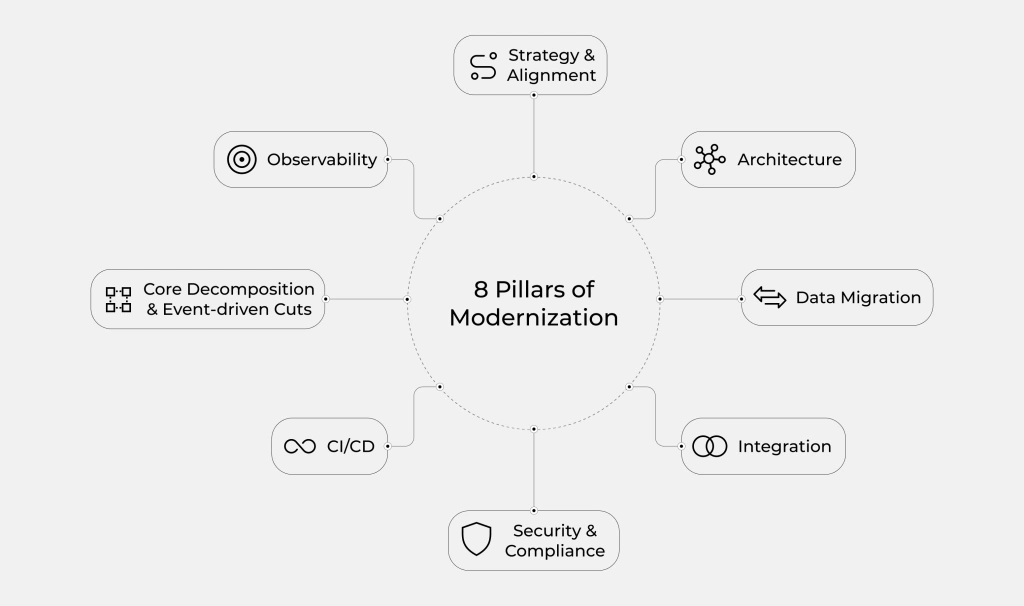

- Pillar 1. Strategy & Alignment: Pick Battles That Move P&L and Risk

- Pillar 2. Architecture: Modular, API-first, Cloud-ready

- Pillar 3. Data Platform & Migration

- Pillar 4. Integration Layer & Interop

- Pillar 5. Security & Compliance by Design

- Pillar 6. Continuous Delivery & Testing

- Pillar 7. Core Decomposition & Event-driven Cuts

- Pillar 8. Observability & Ops

- Change Management & Culture

- Economics & Roadmap

- Case Study: Successful Legacy Modernization in a Financial Institution

- Wrap-up & Next Steps

- Softacom Can Help

- Conclusion

Banking legacy software modernization is no longer optional. Many financial institutions rely on legacy systems that were created decades ago. These aging platforms limit innovation and security. Banking legacy modernization allows organizations to update applications and ensure compliance and continuity. Modernizing helps reduce technical debt and reduce risk exposure.

This playbook explores every aspect of banking legacy application modernization. It covers strategy, architecture, data migration and operational excellence. You will discover how to create a modernization roadmap with your business goals in mind. This will help you turn legacy systems into future-ready core banking platforms.

Key Takeaways

For developers of solutions for banks, modernization is an opportunity and a challenge:

- Banking legacy modernization helps vendors deliver faster, more secure, and more scalable software.

- Strong architecture and automation give clients reliability and compliance they can trust.

Executive Summary & Reader Intent

This guide is written for software vendors that create products for financial institutions. Many banks still depend on legacy systems that make integration and innovation slow.

Adopting banking legacy software modernization practices. This will help software companies future-proof their products. They will be able to provide more flexible integration options for their clients. You will also learn how to align modernization goals with your product roadmap.

Banking Legacy Software Modernization: the Developer-first View

Banking legacy software modernization affects every developer and architect working in core banking. Most legacy systems were built for stability. They resist integration with modern APIs and cloud computing platforms. For developers, the challenge is to maintain business processes and enable new capabilities. And all these should be done simulteneously.

Vendors might become long-term partners to financial institutions. They look for stable and modern solutions.

What Banking Legacy Software Modernization Means for Financial Software Teams

Banking legacy software modernization redefines how software vendors provide products for financial clients. Modernized platforms are easier to maintain and scale. Teams can adopt microservices and CI/CD to ensure their products stay relevant. This is particularly important in fast-changing regulatory and technical environments. Modernization also allows vendors to add new capabilities. For example, they can add business logic faster and support banking standards better.

When legacy modernization is done right, it speeds up delivery with minimized risk. Tools like legacy software modernization services and software migration services provide structured frameworks.

Pillar 1. Strategy & Alignment: Pick Battles That Move P&L and Risk

Modernization should start with business alignment. It means that vendors should set priorities on upgrades that influence the system. For example, improve system stability, security, or compliance for your clients. Or achieve all these goals.

Identify what parts of the legacy stack create the most friction. It can be performance bottlenecks, security gaps or integration limits. You should target those first. A phased modernization plan allows your engineering team to deliver visible results quickly. This, in turn, allows them to show ROI to banking clients.

Pillar 2. Architecture: Modular, API-first, Cloud-ready

Legacy banking systems are often monolithic and hard to maintain. Software providers can add value by delivering modular, API-driven, and cloud-ready architectures. Focus on decoupling services and supporting hybrid or multi-cloud setups. This flexibility allows banks to run mission-critical operations securely. They can also adopt modern cloud computing tools for analytics and scalability.

Pillar 3. Data Platform & Migration

Data migration is a sensitive subject in banking legacy system modernization. Legacy databases may contain decades of customer information. They store transactions, compliance records and customer data.

Vendors developing banking software should design migration pipelines. The criteria for developing are zero downtime and transparent validation. They can use techniques such as CDC (Change Data Capture). CDC allows for moving data gradually and test accuracy throughout. It ensures zero downtime during migration.

Pillar 4. Integration Layer & Interop

Integration is key to modern financial platforms. Software vendors should design systems that connect easily to third-party services. Use gateways, service mesh and adapters. They will ensure interoperability and smooth migration between old and new systems. These practices help clients avoid vendor lock-in and scale efficiently. If the vendor goes out of business, you will be safe.

A robust integration layer lets software providers embed new features into their systems. It’s the bridge between past and future banking systems.

Pillar 5. Security & Compliance by Design

Security must be built into every modernization phase. For vendors, this means embedding secure coding practices and Zero Trust principles. You should make security a foundation of your software. By doing this, you help clients maintain regulatory compliance and avoid costly incidents.

APIs should use encrypted communication and strong authentication to expose core banking securely. The Zero Trust principle verifies and authorizes every request.

Automate security policies with code. Integrate them into CI/CD pipelines for continuous validation. Modernizing legacy systems requires balancing agility with compliance.

Pillar 6. Continuous Delivery & Testing

Modern delivery pipelines are essential for consistent quality. Implement CI/CD to support frequent, stable releases. Include automated tests, static analysis, and infrastructure validation.

If you need to test without interrupting service, use controlled rollouts. For example, blue/green deployments or canary releases. Continuous delivery ensures faster response to client needs and regulatory changes.

Pillar 7. Core Decomposition & Event-driven Cuts

Banking platforms hold critical operations. So, a big-bang rewrite is risky. Gradual decomposition is safer than full rewrites. Use the Strangler pattern to replace old modules step by step. Event-driven architecture helps manage data flow across both legacy and modern systems. This approach helps evolve products faster. At the same time, it keeps client operations uninterrupted, which is critical.

Pillar 8. Observability & Ops

To maintain resilience during modernization, you need full-stack visibility. Observability features like tracing, metrics, and error budgets should help. These tools help banking clients monitor performance and identify issues early. Real-time analytics make modernization measurable and transparent. It proves the stability and value of your platform.

Change Management & Culture

Modernization requires more than technology; it needs a mindset shift. Train teams to understand legacy codebases and modern frameworks. Encourage collaboration. Engineers familiar with old systems should collaborate with developers experienced with modern tools. This balance keeps knowledge intact while accelerating innovation.

Economics & Roadmap

For software vendors, modernization is an investment that strengthens long-term partnerships. Modular design lowers maintenance costs. Reusable components reduce delivery time for multiple clients. Focus on small wins. You can automate deployments or simplifying integrations. Enhancing UI/UX is also critical. These incremental improvements build momentum and deliver measurable ROI.

Case Study: Successful Legacy Modernization in a Financial Institution

A European bank with legacy code from 2007 lacked documentation and internal specialists. They couldn’t arrange modernization. And technical failures in the system influenced the quality of services.

We migrated their systems to AWS and refactored key workloads. We also implemented IAM, autoscaling, and containerization.

The result: lower costs, improved scalability, and easier system updates. It was all achieved without service interruption.

Wrap-up & Next Steps

Banking legacy system modernization is a long-term commitment. Vendors that embrace automation and observability gain a clear competitive advantage. The key is to modernize gradually. Deliver updates in waves, measure progress and retire old modules responsibly.

Softacom Can Help

Softacom helps software vendors modernize products for the banking and finance sector. Our team specializes in Delphi, .NET and AI integrations. We modernize legacy applications safely. Learn more about our legacy software modernization services and software migration services. You can also explore our educational resources: what is legacy application and what is software modernization.

Conclusion

Modernizing legacy banking systems is an ongoing process. It requires strategic planning and technical precision. Banking legacy application modernization transforms financial institutions into agile and compliant organizations. After the modernization, they are ready for the digital future.